Payments Integration: Growing Top-Line Revenue and Valuation in Vertical SaaS

- How vertical SaaS companies can integrate payment processing as a strategy to increase revenue and improve attractiveness in M&A

- How private equity firms and other acquirers view the payments opportunity

In cases where a SaaS solution (particularly a vertical SaaS solution) interfaces directly with the SaaS user’s end customer, SaaS providers have an opportunity to increase top-line revenue and enterprise value through payments integration.

Vertical SaaS refers to cloud-based software solutions that serve a specific vertical/industry, primarily for managing business operations (often generalized as Enterprise Resource Planning, or ERP). An example business in this category is Service Autopilot, which provides software solutions for the lawn care and snow removal industries, among others.

Historically (as in 10+ years ago), the focus of vertical SaaS has been exclusively on business operations, not on financial aspects of the business like payment processing. In the specific case of payment processing, vertical SaaS product providers have shied away from the burden of development required to securely process payments online and comply with financial regulations.

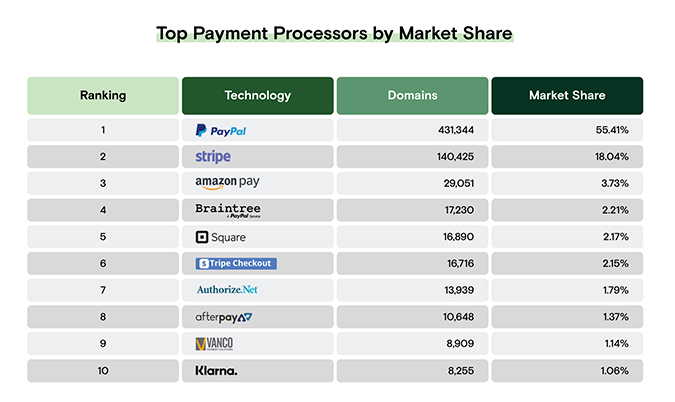

But with the advent of new payment processing companies like Stripe and Square whose products are designed to integrate with other digital platforms, the burden of development and compliance have dramatically decreased.

Payment processing integrations now present a great opportunity for vertical SaaS providers to increase top-line revenue through transaction fees shared with the payment processor.

A Basic Revenue Model That Benefits All Parties

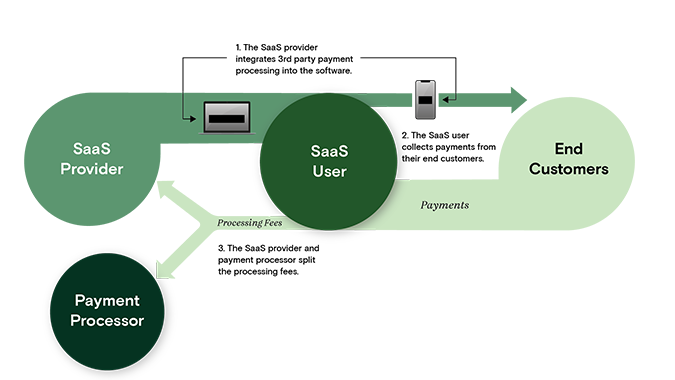

The business model of integrating payment processing is as follows:

- The vertical SaaS provider integrates a payment processing feature into their software that allows the SaaS user to process payments from their customers.

- Following integration, the SaaS user runs transactions with their end customer directly within the vertical SaaS solution.

- For each transaction, fees are collected, which the SaaS provider and the payment processor split between them.

The Payments Integration Model

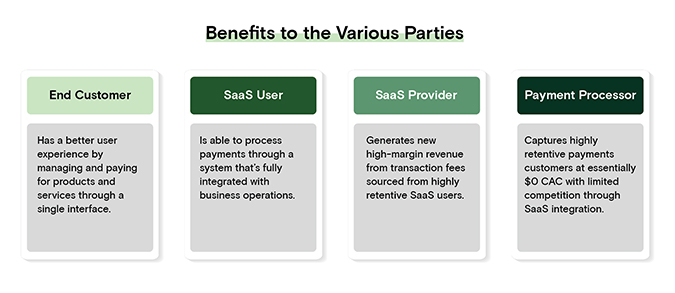

This model benefits all four parties involved in the transaction:

- The end customer benefits because they can pay through an interface they’re likely familiar with, like a web or mobile app.

- The SaaS user benefits because they don’t have to worry about managing disparate software solutions for operations and payments. With payments grouped in as part of a standard workflow in the SaaS solution, the SaaS user benefits from improved productivity and user experience.

- The SaaS provider benefits because they generate new top-line, high-margin revenue from transaction fees on highly retentive SaaS users. Consider that a SaaS user with 100 end customers each averaging $1M in online transactions per year could generate an additional $1M in revenue for the SaaS provider from a basic 1% fee.

- The payment processor benefits because, by integrating with a vertical SaaS provider, they no longer have to compete with other payment processors for the SaaS users’ business, as they are directly integrated into the solution. In addition, through lower competition and greater integration, they also reduce turnover and thus improve revenue.

Integrating payment processing improves quality of business for all parties, but is especially beneficial to the SaaS provider and payment processor because it offers highly predictable, high-margin revenue for each.

What founders need to know and do

Founders should seriously consider the opportunity of integrating payments into their platform if users of their software regularly invoice customers online, or facilitate transactions in any way (online marketplaces, etc.). In most cases, the effort to integrate is minimal compared to the return.

Implications of Payments Integration in M&A

The increase in high-margin revenue from integrating payments is an obvious benefit, but the benefits extend beyond the additional revenue generated. In the M&A world, particularly in private equity, adding a payments feature to a vertical SaaS solution increases the attractiveness of an acquisition and has an upward effect on valuation.

Private equity firms are well aware of how adding payments to a vertical SaaS platform creates new revenue opportunities for vertical SaaS and payment processing companies. As such, PEs have begun acquiring vertical SaaS companies with the goal of integrating payment processing from one of their portfolio companies. (Such was the case in the acquisition of Service Autopilot by Clearent—a payment processor backed by Advent International and FTV Partners.)

By pursuing this acquisition and payments integration strategy, private equity firms are seeking potential opportunities to boost enterprise value for both the payment processor and vertical SaaS portfolio companies:

- By integrating payment processing directly into their vertical SaaS portfolio companies, PEs can boost retention for high-margin payment processing companies, enabling them to increase their exit multiple on the payment businesses.

- By using a proprietary processor, the PE can change the economics of transactions. In other words, the PE can increase the portion of the fees going to the vertical SaaS provider. Doing so increases per customer LTV and top-line revenue for the individual SaaS companies, again increasing the exit multiples at time of sale.

What founders need to know and do

Founders of vertical SaaS companies need to be aware of this M&A trend, as this integration strategy is driving multiples higher for vertical SaaS providers who have either already added a payments feature or could easily do so. Founders can position this opportunity in several ways, depending on their circumstances:

- If vertical SaaS founders have not yet integrated payments, they should demonstrate to acquirers the revenue opportunity in doing so.

- If vertical SaaS founders have integrated payments but not all customers have adopted the feature, founders should help acquirers see the potential for growth.

Payments Is Just the Beginning

Payments integration is one of the more accessible revenue opportunities but is not the only opportunity for vertical SaaS providers to tap into the financial arm of their customers’ businesses. Insurance, lending, bank accounts, and other areas are also becoming more accessible for founders through rapid growth in FinTech. Founders should stay abreast of the integration opportunities that make sense in the industry they serve.